Business recovery from COVID-19 may come sooner than expected, according to an ongoing survey of gaming and hospitality industry professionals

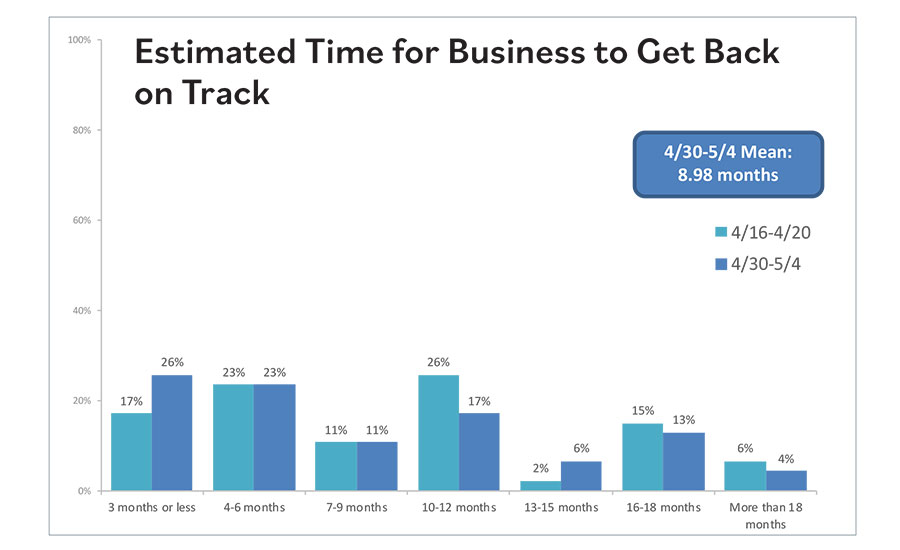

A recent survey of gaming and hospitality industry decision makers regarding coronavirus-related issues showed that a growing number of respondents believe it will take three months or less for their businesses to get back on track.

However, when all responses to this question are considered, the mean time frame for a return to business normalcy comes out to nine months.

The study, entitled “Industry Perspective on the Challenges of Today” and conducted from late March to May by Clear Seas Research, a division of BNP Media, publishers of Casino Journal, found that 26 percent of those surveyed believed business would get back on track in three months, a marked increase over the 17 percent who held this view two weeks prior. Other shorter time frame answers also received strong responses, with 23 percent saying business would be back to normal within six months, and 11 percent within nine months.

But there are still those that believe recovery will take longer, with 17 percent opting for 12 months, 13 percent for 18 months and 4 percent for more than 18 months. The good new among this group: each of these percentages decreased from two weeks previous, showing that—as a whole—industry executives believe it will take less time to recover from COVID-related business problems than previously thought.

In addition to recovery questions, the Clear Seas study addressed a number of other pandemic-related business issues. Among the highlights:

- When asked about their level of concern regarding general business topics, 93 percent said they were concerned about meeting three- month business goals, and 81 percent about reaching six-month business goals, which was down from a high of 84 percent in March. Other areas of concern were the state of the current economy (87 percent), business stability over the next year (87 percent) and supply chain interruptions (72 percent, a jump of 12 percent from March).

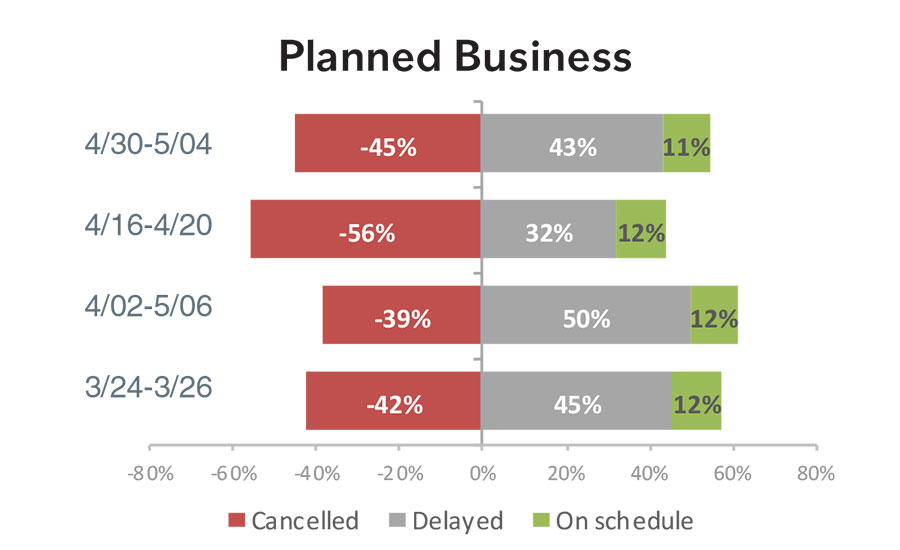

- As one would expect, business spending decisions were gravely impacted by COVID-19, with 54 percent cancelling active business initiatives while 36 percent have put them on hold. When it comes to planned business, 45 percent have cancelled projects while 43 percent have put them on hold. Meanwhile, 93 percent report a decline in new business development activity and 89 percent a decline in business spending on equipment, products and services.

- When asked about anticipated workforce changes over the next three months, 30 percent of respondents said they would need to layoff some employees, while 17 percent said they would have to temporarily suspend some workers without pay. One a positive note, both these categories have declined dramatically from late March, where 52 percent where considering layoffs and 40 percent pay cuts. More recently, 62 percent said they planned on rehiring laid off/suspended employees and 21 percent are contemplating new hires.

- On the subject of employee health and safety, emphasizing handwashing (70 percent), promoting social distancing (67 percent), providing hand sanitizer (63 percent), increasing cleaning/sanitization frequency (63 percent) and providing personal protection equipment (59 percent) are currently the top responses.

Between 35-49 industry decision makers from around the U.S. participated in this survey which took place four times from March 24 to May 4. For a full copy of this study, visit www.clearseasresearch.com.