The American Gaming Association’s (AGA) Commercial Gaming Revenue Tracker features monthly and year-to-date gross gaming revenue (GGR) at a state and national level, broken down by individual gaming verticals.

October Commercial Gaming Revenue

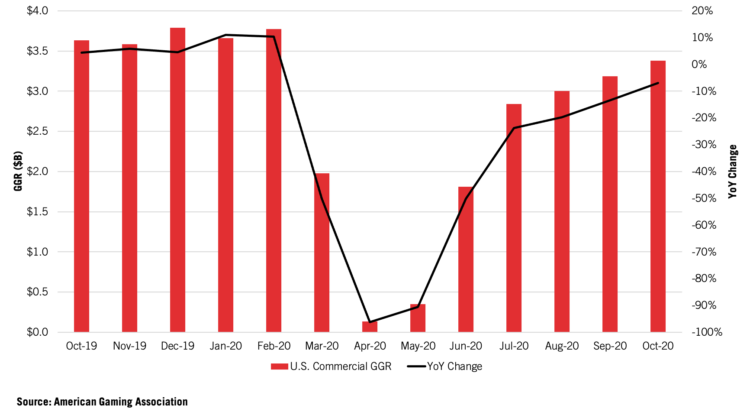

October marked the sixth consecutive month of recovery for the commercial gaming industry following April’s historic low-point. Gaming revenue rose 6.3 percent from September to $3.38 billion in October, reaching 93.0 percent of the industry’s revenue levels from October 2019.

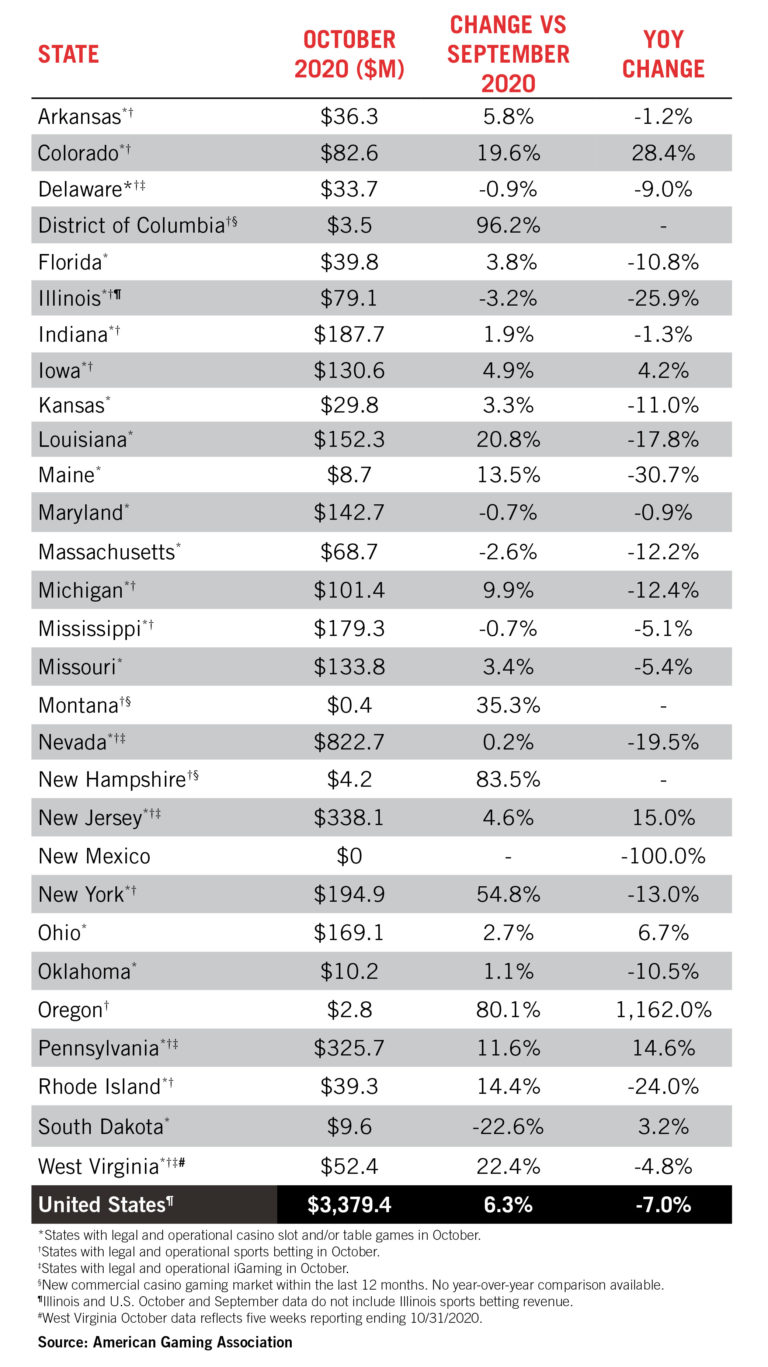

Nearly all commercial gaming jurisdictions showed positive signs of ongoing recovery in October, despite continuing to operate with limited capacity, game availability, and non-gaming amenities. Ohio recorded a fourth consecutive month of year-over-year gaming revenue gains, while South Dakota has experienced revenue growth in each of the past five months. Colorado, Iowa, New Jersey, and Pennsylvania also saw revenue gains over October 2019 powered by strong sports betting and iGaming performance. Of the remaining commercial gaming jurisdictions, all but four reported either higher revenue yields or reduced year-over-year revenue declines compared to September.

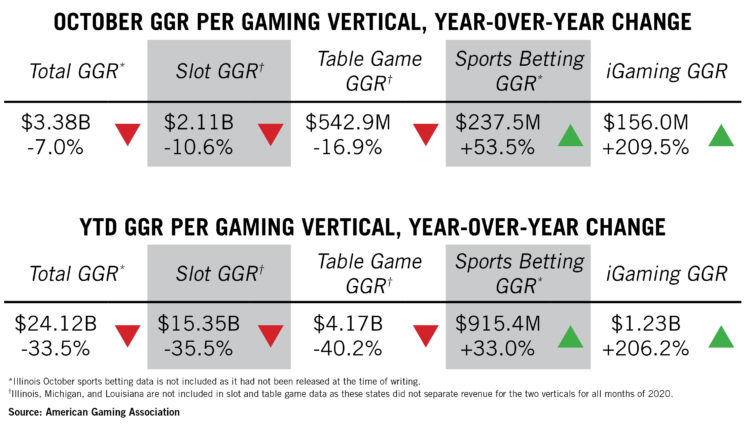

While sports betting and iGaming continue to be the most visible drivers behind gaming’s recovery, legacy gaming is also improving month-over-month. Combined GGR from slot and table games rose 3.4 percent from September to $2.98 billion in October, equal to 86.6 percent of the industry’s levels from October 2019.

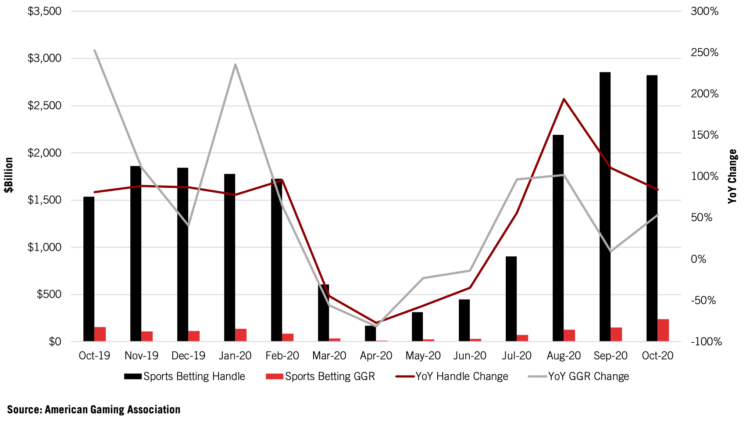

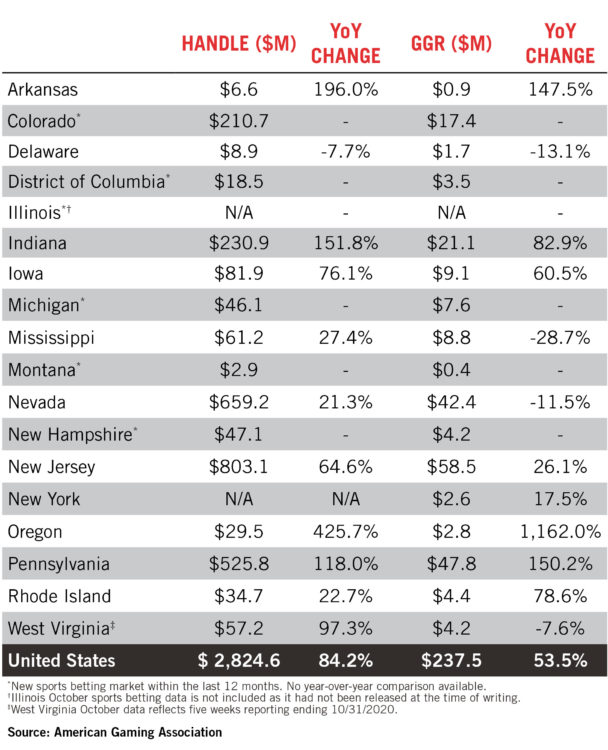

October is likely to be strongest months for legal sports betting in U.S. history as Americans wagered at least $2.82 billion on sports across 17 states and the District of Columbia. (This number is expected to surpass $3 billion upon the release of the October revenue report for Illinois – the fourth largest market in September.) Along with a likely record handle, the quickly growing U.S. legal landscape also reached record revenue, with an all-time high combined hold of at least $237.5 million, including free bets and promotions. That equals a gain of 53.5 percent over the previous record month, October 2019.

Sportsbooks in all but two states accepted more money in sport wagers in October than in any previous month. While Nevada reported an all-time high state handle, New Jersey broke the national handle record for a third consecutive month. In the first ten months of 2020, national sports betting handle is up 48.0 percent while revenue grew 33.0 percent over the same period in 2019.

About the Report

AGA’s Commercial Gaming Revenue Tracker provides state-by-state and nationwide insight into the U.S. commercial gaming industry’s financial performance. Monthly updates on AmericanGaming.org feature topline figures based on state revenue reports while quarterly reports provide a more detailed analysis covering the three previous months.